Dubai, January 31, 2024

[Alpen Capital] GCC Insurance Industry poised for accelerated growth in the next five years, forecasts Alpen Capital

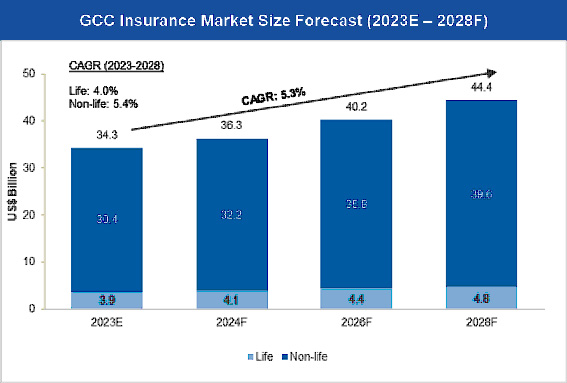

UAE-based investment banking advisory firm, Alpen Capital projects the gross written premium (GWP) of the region to grow at a CAGR of 5.3% reaching US$ 44.4 billion by 2028, in its latest GCC Insurance Industry report. The non-life insurance segment is anticipated to grow at a CAGR of 5.4% between 2023 and 2028 reaching US$ 39.6 billion, comprising 89.2% of the region's GWP by 2028.

The report provides a comprehensive overview of the GCC insurance sector, outlining recent trends, growth drivers and challenges. It also profiles select insurance companies in the region.

The report was launched over a webinar followed by a panel discussion featuring Fareed Lutfi, Secretary General, Emirates Insurance Association and Gulf Insurance Federation; Sunil Kohli, Chief Executive Officer, Dhofar Insurance Co.; and Krishna Dhanak, Managing Director, Alpen Capital. Hameed Noor Mohamed, Managing Director, Alpen Capital moderated the discussion.

The GCC insurance industry has grown consistently in recent years, propelled by the economic rebound following the COVID-19 slowdown and the successful implementation and advancement of mandatory health insurance across GCC countries. This positive trajectory is expected to accelerate in the long term, fueled by sustained economic diversification initiatives, population growth, and substantial infrastructure development within the region. Both regulators and insurance companies in the GCC are focusing on improving operational efficiency, enhancing customer experience, and diversifying insurance product offerings in collaboration with Insurtech companies. Insurtech is also enabling insurers to provide customized products that cater to individual needs, leading to a further increase in demand for insurance.” says Sameena Ahmad, Managing Director, Alpen Capital (ME) Limited.

The insurance industry in the GCC has experienced a surge in M&A activities in the past couple of years driven by strategic plans of the operators to expand their geographical presence, regulatory changes, increased operating expenses, competitive pressures, and a scarcity of available insurance licenses. Regional insurance companies are looking to invest in Artificial Intelligence, Internet of Things, and blockchain in product development to enhance customer support, real-time monitoring of claims and prevent fraudulent claims. We are also witnessing interest for outbound cross-border M&A within the Middle East region from players in the GCC as well as inbound interest from strategic players to enter into the GCC market. Looking ahead, M&A activity in the region is expected to continue and we anticipate a heightened focus on collaborations with Insurtech companies to create new models and enhance operational efficiency”, says Krishna Dhanak, Managing Director at Alpen Capital.

According to Alpen Capital, the GCC insurance market is expected to grow at an annualized growth rate of 5.3%, reaching an estimated US$ 44.4 billion in 2028 from US$ 34.3 billion in 2023. The growth outlook remains favorable, driven by resilient economic growth, a sustained increase in population, a rising need for health and life insurance, and ongoing infrastructure development projects. The life insurance GWP is projected to grow at a CAGR of 4.0%, increasing from US$ 3.9 billion in 2023 to US$ 4.8 billion in 2028. Meanwhile, the non-life insurance segment in the GCC is estimated to grow at a CAGR of 5.4%, expanding from US$ 30.4 billion in 2023 to US$ 39.6 billion in 2028. This growth is primarily expected to be driven by the expanding tourism sector and a robust pipeline of real estate projects at various stages of completion across the region. Insurance density is expected to increase from US$ 597.6 in 2023 to US$ 699.5 in 2028, while insurance penetration is anticipated to change marginally during the same period.

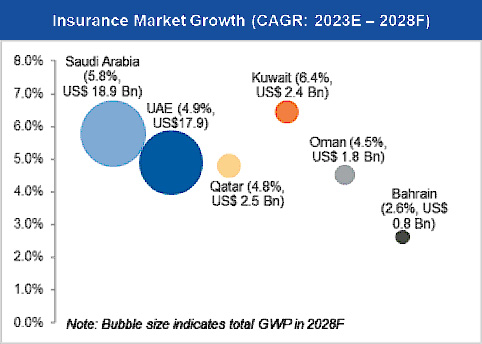

Saudi Arabia surpassed the UAE to become the largest insurance market in the GCC in 2022, driven by massive infrastructure development and an increasing demand for motor and medical insurance. Alpen Capital anticipates this trend to persist, forecasting a CAGR of 5.8% for the Kingdom between 2023 and 2038. The UAE’s insurance market is expected to grow at a CAGR of 4.9%, while Kuwait is projected to witness the highest growth rate in the GCC at a CAGR of 6.4%, attributed to steady population growth between 2023 and 2028 and increased government investments in infrastructure.

The report highlights sustained growth momentum buoyed by increased domestic demand, ongoing reform initiatives, booming tourism segment, and a rebound in the hydrocarbon market as factors driving growth within the insurance industry. Furthermore, economic diversification strategies are anticipated to drive increased spending on sustainable and alternative infrastructure projects, thereby augmenting the region's insurable assets. The GCC insurance market is poised to benefit from a rising population that is expected to reach 63.4 million by 2028, representing a CAGR of 2.0% since 2023. The ongoing expansion of mandatory medical and business lines is likely to contribute to an increased demand for insurance products, stimulating overall growth in the insurance industry.

However, the industry is not devoid of its challenges. The fragmented and highly competitive nature of the market fosters price competition to secure business, posing a threat to profit margins for insurers. The implementation of the IFRS 17 standard has introduced complex accounting frameworks, compelling insurers to substantially change their existing processes, proving particularly challenging for medium-sized providers. Rising cession rates and hardening of the reinsurance market has the potential to disrupt business models and adversely affect reinsurance revenues and underwriting margins of insurers. Furthermore, claims inflation and increasing tax rates could potentially impact core business lines, especially motor and medical insurance segments that account for a major portion of the GWP of GCC insurers.

The report notes that the GCC region stands as an early adopter of global digital transformation, presenting significant opportunity for insurers to develop a digital ecosystem, enhancing customer experience while reducing customer acquisition costs. To build a more secure ecosystem, the GCC governments are prioritizing personal data protection, creating opportunities for new products such as cyber insurance. GCC’s focus on digitalization is creating several opportunities for Insurtech companies to reshape the insurance industry using technology, data, and customer-focused approaches. Furthermore, the region is witnessing a rise in credit insurance driven by the complexities of global trade and economic uncertainties.

The GCC insurance industry is undergoing significant transformation, fueled by favorable demographics, robust economic factors, advancement of mandatory health insurance, technological advancements, and a growing demand for innovative products. The region’s insurance landscape is maturing, with supportive government regulations continuously seeking to enhance both the regulatory environment and operational efficiency to ensure a sustainable business model.

To download the report, please click here.